After using the SoFi Checking & Savings account for the past 6 years, I’m going to go over five things I wish I knew before opening an account. If you’re thinking about signing up for SoFi (be sure to use this link to grab a $325 welcome bonus if you are), then this post is for you.

This isn’t a hit piece; far from it. SoFi is genuinely a fantastic bank, but it comes with a few trade-offs you need to be aware of. So, for the benefit of anyone considering making the switch to SoFi, let’s get started.

This post may contain affiliate links, meaning I get a commission at no cost to you if you decide to make a purchase through my links. Visit this page for more information. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

#1: The High Rate Offered Is Not Standard

Number one is to know that the high rate offered on the savings account is conditional.

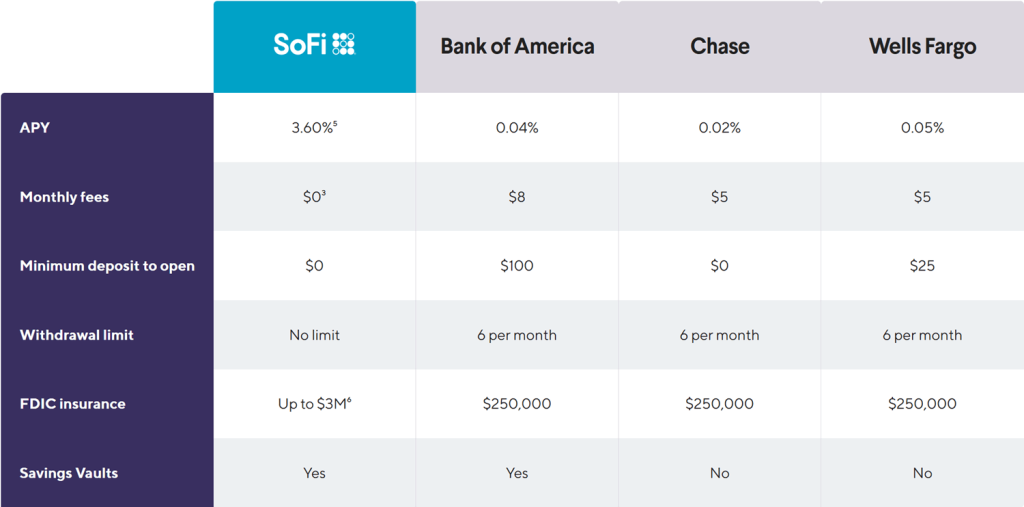

This is arguably the most critical piece of information that so many people miss. Like many people, I was initially drawn in by the headline rate you can earn on your savings: enjoy a 3.60% APY, a rate that’s 9 times more than the national average.

Automatic money growth. Great, right?

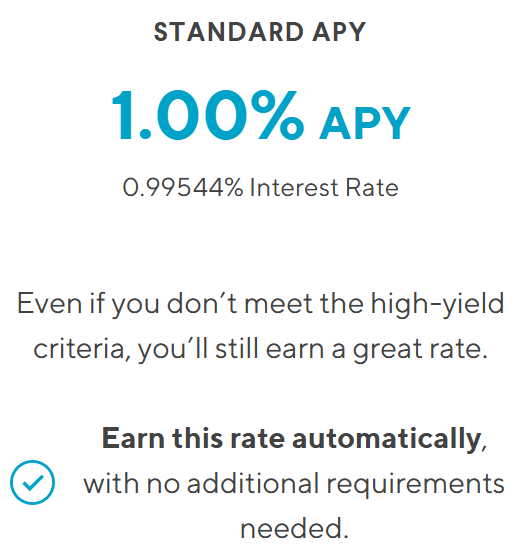

What I didn’t fully realize until I read the fine print is that this top-tier rate is entirely conditional. The standard rate for everyone is 1% – better than the big banks, but nothing to write home about. To get the higher rate, you need to do one of these three things.

The first is the easiest: setting up an eligible direct deposit. And when I say eligible, I mean receiving regular income from an employe or government benefit – not just depositing money into your account, but a real direct deposit.

The second is depositing at least $5,000 every 30 days. This is really straightforward if you have the money to do so.

The third option is to become a SoFi Plus member. For now, you get SoFi Plus status automatically when you receive a direct deposit in any amount each month. Starting on March 31, 2026, however, you’ll need to pay a $10 monthly fee to keep this membership level. So, I don’t think this option will be popular for most people.

If you can’t or don’t want to do one of those three things, your rate will drop dramatically. Right now, the standard, non-qualifying rate is a less exciting 1% APY. While 1% still crushes most brick-and-mortar banks, it’s a far cry from the 3.60% rate.

The lesson here is simple: if you can’t make SoFi your primary hub for payroll or make large deposits each month, you should seriously weigh whether the rest of the features are worth it.

#2: Can’t Deposit Physical Cash

When you move from a traditional bank, you get used to certain conveniences that you simply take for granted, like depositing physical cash or instantly sending money to a friend at a different bank.

Like other online-only banks, you quickly realize that the freedom from bank branches comes with a few sacrifices.

For instance, making cash deposits. Since SoFi is a 100% online bank, there’s no teller window to slide your money across. If you get cash as your income or receive them as tips, you’ll need to deposit them first at a traditional bank before transferring the funds to SoFi. It’s not a dealbreaker, but it’s a potential headache for some people.

#3: Zelle Isn’t Streamlined Compared To Other Banks

Ok, let’s talk about the Zelle situation. I’m not sure if you’re experiencing this too, but I get less and less friends who will PayPal me and now they’ll say, “Venmo me” or “Zelle me” instead.

And while SoFi does support Zelle and it’s free to use, it’s not natively integrated into the SoFi app like it is with other banks.

The SoFi app opens a different window to use Zelle and you have to manually link it to your SoFi account. At the time of making this video, Zelle is not even offered to every SoFi user. Supposedly, you’ll get access to Zelle if you have a direct deposit, but this is an inconvenience that other banks don’t force on you.

This is a minor con overall, but in the world of instant P2P payments, it sticks out like a sore thumb.

#4: SoFi Is An Entire Ecosystem

Number four is to understand that you’re not just opening a bank account – you’re adopting an entire ecosystem.

One of the unexpected benefits is how deep the entire SoFi platform is. I initially just wanted the checking and savings account, but the reality is, SoFi is a full-service platform, and you get the best value when you embrace it all.

A big selling is the SoFi Plus membership I mentioned earlier. There are over 20 benefits you get with SoFi plus.

The newest benefit is getting unlimited 5% cash back rewards at grocery stores with the SoFi Smart Card. That matches the best rates offered by other major credit card issuers.

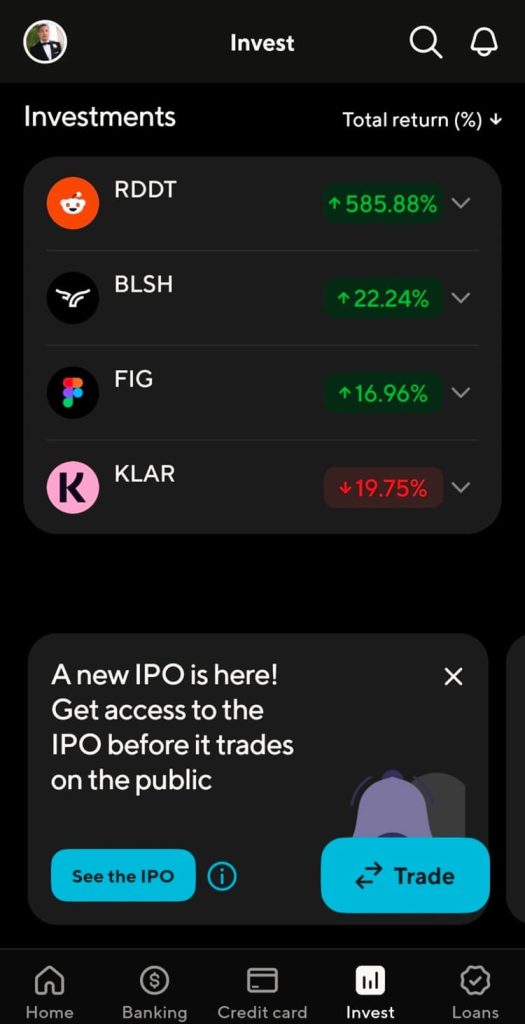

Another example is receiving a 2% bonus on IRA contributions and 1% bonus on deposits to your SoFi Invest account.

You also get access to IPOs, which means you’ll be able to buy stocks in companies right when they go public. That’s how I got access to Reddit on Day 1 and now it’s up a crazy 585%!

Yet another perk is when you’re ready to buy a house, SoFi offers a $1,000 home mortgage discount to SoFi Plus members.

This is where SoFi truly sets itself apart from its high-yield competitors, which usually just offer a simple savings vault.

#5: The Interest Rate Is Variable = Best Rates vs Loyalty

Number five is for people who chase the best interest rates. Loyalty doesn’t guarantee a rate. I’m guilty of this as well.

We sign up for a new bank account that offers an incredibly high rate and forget a fundamental truth about high-yield savings: the APY is variable.

This isn’t a fixed-rate CD. The rates on savings accounts are tied indirectly to the Federal Reserve’s interest rate policies. I assumed that because SoFi was aggressively pursuing new customers, they would hold the rate steady, or at least be slow to drop it.

The hard lesson learned here is that SoFi, just like every other bank, will adjust its rate in response to economic shifts. When the Fed raises rates, SoFi is quick to pass those benefits on to you, which is great. But when the tides turn and rates drop, SoFi will reduce your yield.

This requires you to keep paying attention. You can’t just “set it and forget it”, or you risk waking up a year from now and find your rate has been cut in half. Always compare the rate offered by SoFi against other competitive high-yield savings accounts to make sure you’re always maximizing your returns.

The Bottom Line

So, having gone through the initial excitement, the minor frustrations, and the deeper understanding of the system, here’s my verdict and who should sign up.

Honestly, despite some of the things I’ve said, the SoFi Savings and Checking account is still one of the best banking platforms for most people, especially for those who are tired of being nickel-and-dimed by traditional banks. The benefits far outweigh the minor compromises.

If you want to give SoFi a try, the great news is that they’re offering a $325 sign-up bonus for you to give it a spin.

Plus, SoFi will give you a 0.70% APY boost on top of its current rate of 3.60% for the first six months. That means you’ll enjoy earning 4.30% for half a year. Unless someone tells me in the comments that I’m wrong, I believe that’s the absolute best rate you can get right now for a savings account.